U.S. Betting Map

Click through the map to learn about legal betting options and rules in your state.

-

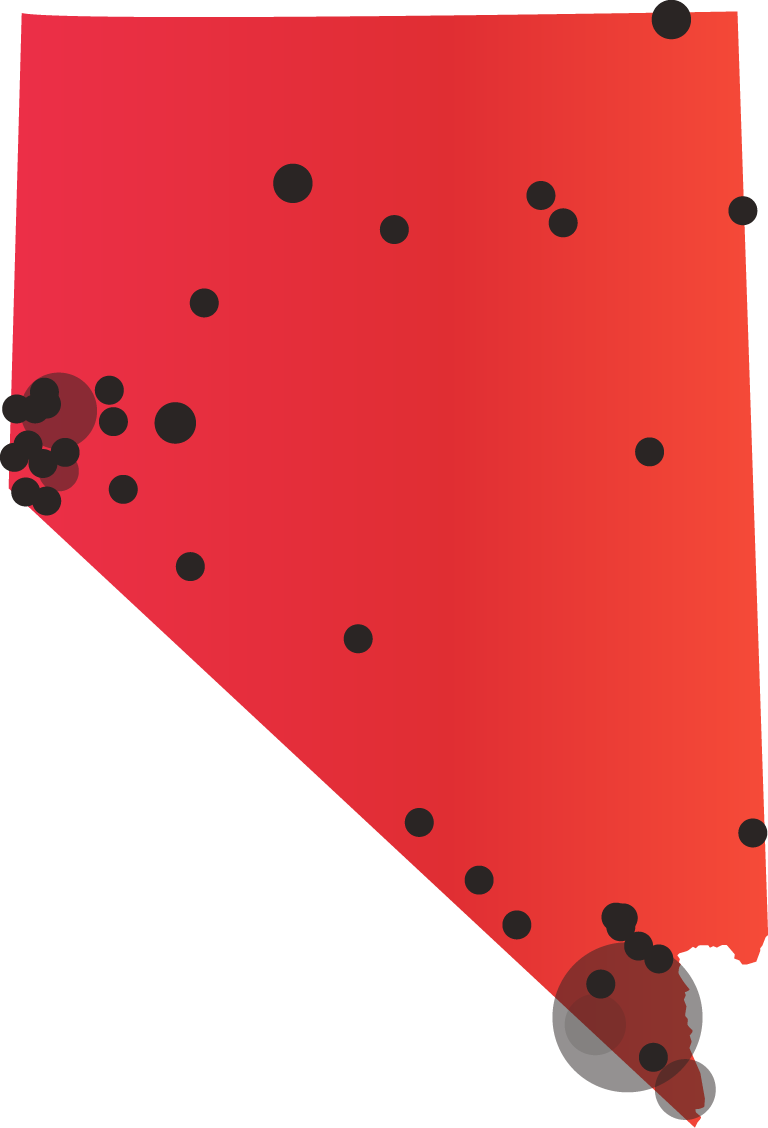

Number of Casinos 225

-

Economic Impact $59.37 Billion

-

Jobs Supported 330,074

-

Tax Impact & Tribal Revenue Share $8.01 Billion

-

Gross Gaming Revenue $15.52 Billion (2023 Commercial)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

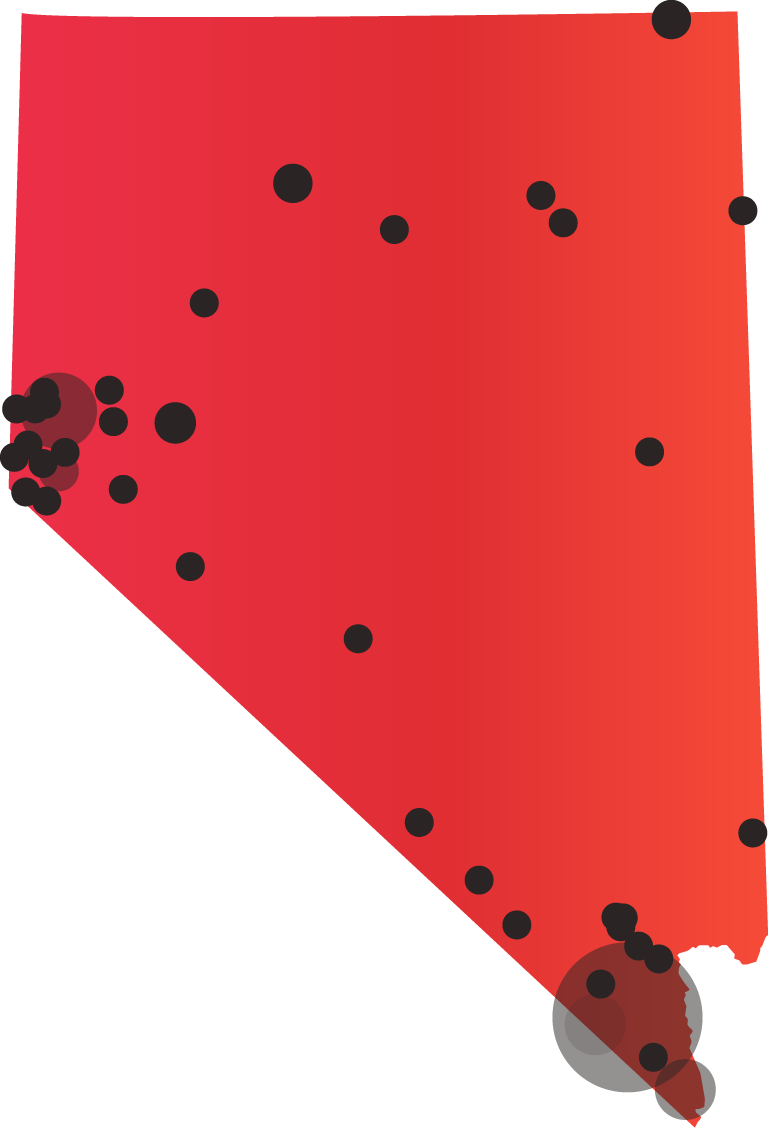

Number of Casinos 225

-

Economic Impact $59.17 Billion

-

Jobs Supported 328,307

-

Tax Impact $7.97 Billion

-

Gross Gaming Revenue $15.52 Billion (2023)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

-

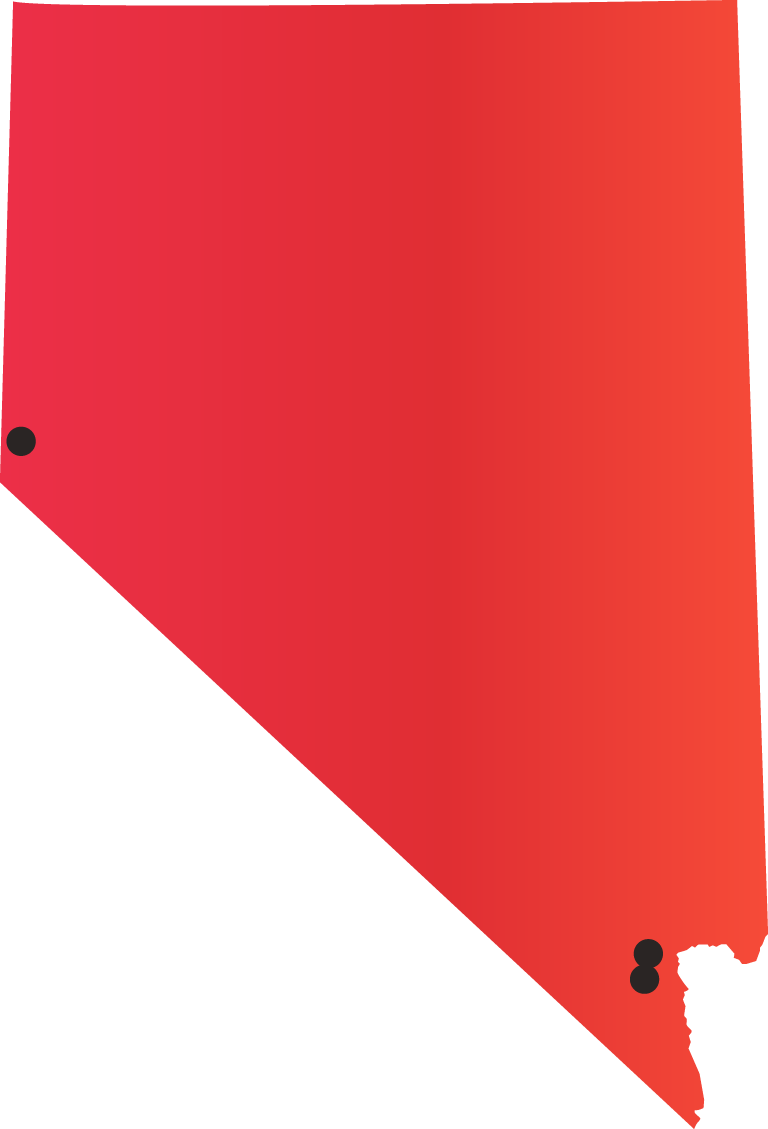

Number of Casinos 4

-

Economic Impact $202.3 Million

-

Jobs Supported 1,767

-

Tax Impact & Tribal Revenue Share $34.2 Million

-

Gross Gaming Revenue N/A

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2023.

Nevada Gaming Control Board

555 East Washington Avenue

Suite 2600

Las Vegas, NV 89101

The regulatory oversight of all gambling in the state is conducted through a two-tier system comprising the Nevada Gaming Commission and the Gaming Control Board. The commission is primarily responsible for acting on recommendations of the board for licensing matters. The commission is the final authority on

licensing matters. The board is split into multiple divisions and serves as the enforcement, operational, and investigative body for the state’s gaming industry.

AVAILABLE GAMING LICENSES

Nonrestricted Gaming License

Restricted Gaming License

Interactive Gaming License

Distributor License

Manufacturer License

Manufacturer of Interactive Gaming Systems License

For more information on available gaming licenses, see Regulatory Fact Sheet.

According to the Nevada Gaming Control Board, the state of Nevada has active tribal-state gaming compacts with four tribes:

- The Fort Mojave Indian Tribe;

- The Moapa Band of Paiute Tribe;

- The Las Vegas Paiute Tribe; and

- The Pyramid Lake Paiute Indian Tribe.

Tribes have the exclusive right to regulate Class III gaming on tribal reservations. The state of Nevada plays a major role in licensing in the state.

Some of the state’s compacts expire in yearly intervals, while others do not expire until both the tribe and state file a written agreement terminating gaming activities.

AVAILABLE GAMING LICENSES

Management Company License

Manufacturer/Distributor License

For more information on available gaming licenses, see Regulatory Fact Sheet.

| GAMING TAX RATE | |

| In Nevada, the tax on gross gaming revenues, including sports wagering, is graduated as follows: | |

| Gross Gaming Revenue | Graduated Tax Rate |

| $0 – $50,000 | 3.5% |

| $50,000 – $134,000 | 4.5% |

| Over $134,000 | 6.75% |

| Counties and municipalities may impose additional fees and levies, adding approximately 1 percent to the tax burden. | |

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

None

TAX REVENUE ALLOCATION

The vast majority of tax revenue from gaming is directed to Nevada’s General Fund, then redistributed on a biennial basis, at the direction of the legislature, for purposes including statewide education programs, transportation services and general budgetary needs. Additional monies are funneled to local school systems and county governments.

REVENUE SHARE

The tribes do not share any proceeds from Class III gaming with the state.

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

None

TRIBAL USE OF REVENUE

Requirements as described in IGRA.

STATUTORY FUNDING REQUIREMENT

Deposit $2 for every slot machine that is subject to a license fee

SELF-EXCLUSION

None

COMPLIMENTARY ALCOHOLIC DRINKS

Allowed

ADVERTISING RESTRICTIONS

Failure to conduct advertising and public relations in accordance with decency & dignity are grounds for disciplinary action. This includes interactive gaming advertisements.

ON-PREMISE DISPLAY REQUIREMENT

Problem gambling information must be prominently displayed near gaming areas, cage areas and ATMs

AGE RESTRICTIONS

21+ years of age to gamble

21+ years of age on floor

STATUTORY FUNDING REQUIREMENT

None

SELF-EXCLUSION

None

COMPLIMENTARY ALCOHOLIC DRINKS

Allowed in some cases

ADVERTISING RESTRICTIONS

None

ON-PREMISE DISPLAY REQUIREMENT

None

AGE RESTRICTIONS

21+ years of age to gamble

OPERATION ON HOLIDAYS

Yes

TESTING REQUIREMENTS

Nevada uses independent testing laboratories to certify gaming equipment.

ANTI-MONEY LAUNDERING REQUIREMENTS

Uses federal compliance.

SHIPPING REQUIREMENTS

Unless exempted by regulation or waived by the NGCB, NGCB must approve the transportation of gaming equipment.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

None

CREDIT OFFERED TO PATRONS

Yes

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrencies are not currently accepted as a form of payment for gambling transactions.

TESTING REQUIREMENTS

Tribe agrees that all gaming devices exposed for play shall be approved by the State and will meet all standards established by the State for non-Tribal gaming including, but not limited to, the hold percentages on slot machines.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements under the Bank Secrecy Act.

SHIPPING REQUIREMENTS

Federal shipping requirements under the Johnson Act apply.

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

Yes

CREDIT OFFERED TO PATRONS

None

SMOKING BANS

No

CASHLESS GAMING & ALTERNATIVE PAYMENTS

Yes. However, cryptocurrencies are not currently accepted as a form of payment for gambling transactions.

AUTHORIZED OPERATORS

Commercial and tribal casinos

MOBILE/ONLINE

Mobile allowed statewide

TAX RATE

6.75 percent

INITIAL LICENSING FEE

None

LICENSE RENEWAL FEE

None

AMATEUR RESTRICTIONS

None

TAX ON PROMOTIONAL CREDITS

No

AGE RESTRICTIONS

Must be 21 years old.